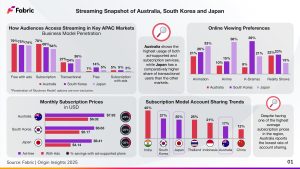

Insights into the APAC streaming landscape reveal three mature but distinctly shaped markets, each with strong engagement across subscription and ad-supported models. Australia stands out for having the highest use of both paid and ad-tier services, despite also posting some of the region’s highest subscription prices. Japan, meanwhile, shows the strongest inclination toward transactional viewing, with 36% of users renting or buying content. South Korea reports the highest use of free services in the region at 14%. Audiences show a strong preference for local content (77%), yet still favour English-language programming in its original audio with subtitles rather than dubbed versions.

The full APAC Report can be viewed in the Members Area of the BASE website.

Today, DEGI: The Digital Entertainment Group International, in partnership with Fabric, is pleased to unveil its seventh report on global regions and country deep-dives, focusing on the entertainment landscape of Asia-Pacific. This comprehensive overview, exclusive to BASE and DEGI members, offers valuable insights into Australia, South Korea, and Japan, including transactional trends in these countries. It highlights Australia’s high usage of both ad-supported and subscription services, and Japan’s comparatively higher share of transactional users than the other markets.

This exclusive DEGI and BASE member report dives into the evolving streaming landscape and trends across APAC’s biggest markets. With extensive transactional catalogues in Japan, with top platforms offering more than 58,000 titles, Japan leads APAC in transactional, with 36% of viewers renting or buying content. South Korea’s streaming ecosystem is driven by strong local dominance, with domestic platforms offering the deepest Korean content catalogues and more than 77% of viewers preferring homegrown entertainment. Despite this, South Korean audiences have a strong preference for English-language programming in its original audio with subtitles rather than dubbed versions. The Australian market boasts a vast content library of more than 146,000 titles across 580 streaming services, creating a highly competitive environment. Within this landscape, the penetration of ad-supported subscription plans has surged by 84%, reflecting the 58% of Australians who prefer lower-cost options with ads. At the same time, 42% of subscribers still opt to pay more for an ad-free premium experience, highlighting a clear divide in consumer preferences despite the abundance of available content.

Tom Gennari, Chief Data Officer at Fabric said, “This latest report offers an in-depth view into how audiences across Australia, South Korea, and Japan are shaping the evolution of streaming in the APAC region. With Fabric’s Origin Insights, we continue to equip the industry with comprehensive data on regional behaviours and emerging monetisation models, empowering media companies to adapt strategies, optimise offerings, and connect with audiences across one of the world’s most dynamic entertainment ecosystems.”

The full report will be shared with BASE and DEGI members and available in the Members Area of the BASE website. For access to the full report, as well as more insights from Fabric, please contact Yasmin Nevard, Head of Insights at DEGI.

Please contact Louise Kean-Wood if you would like to learn more about becoming a member of DEGI.